The financial sector is undergoing significant change, and the collision of artificial intelligence (AI) and financial technologies (fintech) is at its center.

Rapid progress means that innovations are coming hard and fast. Indeed, the customer experience is being transformed like never before. But, what’s happening behind the scenes is just as impressive—and important.

The fintech universe is increasingly powered by AI. And, at the moment, the leading edge of this “AI in fintech” story features the powerful tools of machine learning (ML) and deep learning (DL).

Fintech is profoundly affected by artificial intelligence, and one area where we can see the application of this powerful new tool is in the realm of fraud detection and prevention. Traditional rule-based systems don’t always catch sophisticated scams because they’re not very sophisticated themselves. By contrast, AI-driven systems continuously learn from vast amounts of data and adapt to new fraudulent threats. It works better (and costs less) than the old way of doing things.

Another area where AI is making a big difference in fintech is with investment advice. In the past, financial advice was mostly reserved for people with lots of money, but now AI is helping to democratize it. Classify this adventure under the “big difference” category, because personalized investment guidance is now available to anyone like me who doesn’t have much money but does have a terrible investment record.

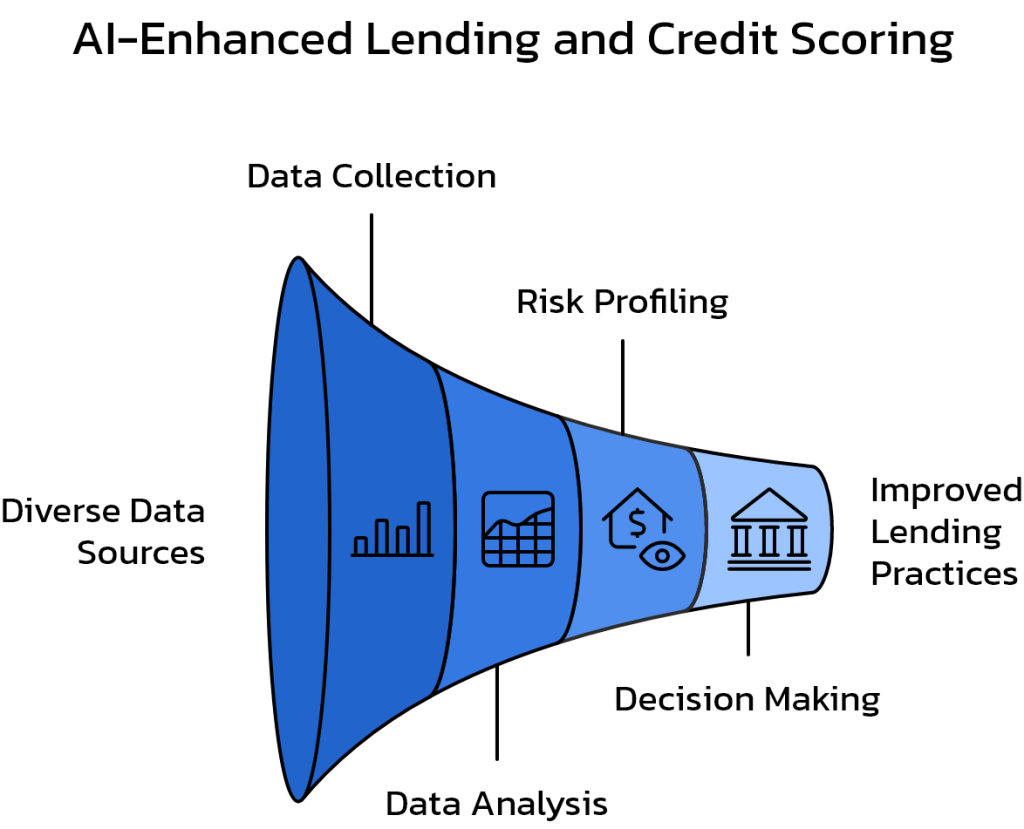

The lending and credit scoring environments are changing. The old ways, encumbered by a lack of data and inherent biases, do not work anymore and are giving way to artificial intelligence. Most of the algorithms that these young companies use to determine if you are a good risk work on a whole different level of logic and, above all, a whole different level of data.

They access a wider range of data points, from rental payment histories (data not generally accessed by banks but which is in the public domain) to your social media activity. They use all this information to assemble much more comprehensive risk profiles than traditional banks can.

Innovative future collaborations between fintech firms and AI technology providers will probably lead to unprecedented change in the finance sector.

Although such partnerships may encounter obstacles—conflicts related to data privacy, for example, or difficulties arising from algorithmic biases—fintech and AI together offer enormous potential. If used responsibly, AI will drive innovation, efficiency, and personalization in finance to exhilarating new heights.